The 2-Minute Rule for Gold American Eagle 1 Oz

The 2-Minute Rule for Gold American Eagle 1 Oz

Blog Article

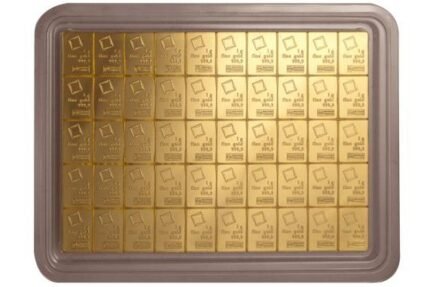

Coins have the principle benefit of becoming divisible, While it's important to own some primary notions of numismatics just before buying them for the reason that Despite equal excess weight, they don’t always hold the exact value. The purchase of compact bars makes it possible to invest in a number of tranches and also to partially resell your stock inside the celebration of the urgent need for liquidity.

Many individuals are diversifying their retirement funds by investing in gold through a “Self-Directed IRA.” Contrary to a traditional IRA, a Self-Directed IRA allows men and women to take a position in a broader range of assets, and spend money on precious metals—while benefiting from comparable tax strengths as a normal IRA.

No. Only funds contributions are allowed to be designed with the exception of transfers or rollovers. You should utilize the resources inside the IRA to purchase valuable metals that could be sent straight to the custodian’s depository. You can not incorporate gold or other metals for your storage Regardless of meeting the requirements.

Acquiring Actual physical gold bars and gold coins is straightforward and lets you purchase in smaller dollar amounts. Nevertheless, bear in mind you’ll be answerable for storage, insurance, together with other ongoing fees—which may be expensive and dangerous.

Diversification: As an alternative to putting all your money into shares or real estate property, diversify your portfolio by including gold bars like the Valcambi one oz gold bar.

S. Income Reserve. We’ll wander you thru how to purchase gold, silver, platinum, or palladium, from the moment you select to add valuable metals for your portfolio and need to know where to buy gold and also other valuable metals to the moment your order ultimately arrives at your doorstep.

Connect with today for a free consultation by using a well-informed Account Government who might help reveal treasured metals ownership, how to produce valuable metals an element within your portfolio, and techniques to trace the metals’ effectiveness.

Ahead of we dive into the how and why of gold bar investing, Permit’s very first examine the kinds and varieties of valuable metals. As described, you will discover other treasured metals worth investing in Aside from gold. Right here’s what to find out about the differing types of treasured metals.

As described, valuable metals are thought to function a hedge towards inflation, this means their value may possibly continue being stable When the inventory sector crashes. And, not like other Actual physical assets That always depreciate with time, investigation implies that precious metals can retain or recognize in value.

To that stop, you should know that many advertisers shell out us a cost for those who purchase goods immediately after clicking links or calling cellphone figures on our Internet site.

Nonetheless, their precious steel value usually exceeds their face value definitely. You can also find coins without having deal with value given that they are issued by non-governmental entities. They are generally called 'rounds' and customarily Possess a very low numismatic value, and therefore a reduced high quality.

Down below, we’ll dive into what you have to know about buying gold bars and other cherished metals.

Gregory - 2/19/2022 "I've created a few orders from Provident and have not been upset. Their customer service is great. It's very reassuring When you've got a considerable quantity of metals from the mail to concentrate on the many ways in shipping and the exact site of your order. Keep up the good operate and you will often have me for a customer." George - 2/19/2021 "I have purchased many periods from Provident and never had a Argor-heraeus Kinebar Gold Bar concern. They are so useful with every single transaction with them. They mail out conformation immediately and Verify in your order right up until you receive it where you asked for it to go. Simply just, Provident is my supplier, time period.

As the price of gold is comparatively secure, many investors choose when to get based on their own fiscal condition, instead of around the price of gold at any supplied time.